Property | 30 April 2024

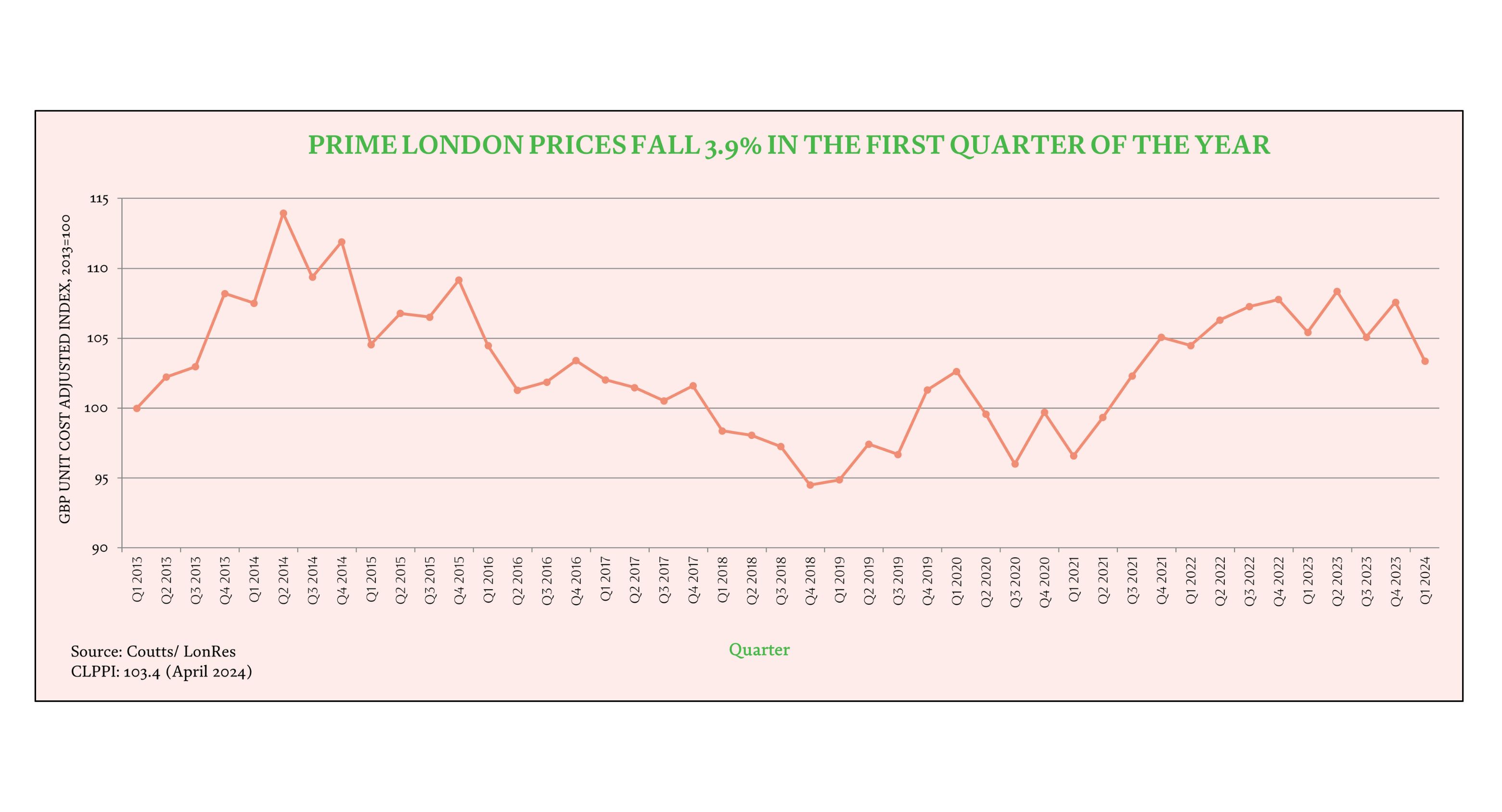

London Prime Property Index Q1 2024 shows fall in prices – but is a rebound due?

A sluggish start to the year translated into a 3.9% drop in prime London prices – but a comeback could be long overdue.

KEY STATS

3.9%

The drop in prime London prices in the first quarter of the year

8.9%

The average discount buyers are getting on prime London properties

9.1%

How much transaction volume on super prime £10m+ properties is up on last year

“The general consensus is that price growth will be pretty flat this year but over the next five years, Prime Central London should outperform the rest of the market as price growth has been subdued over the last ten years,” says Katherine O’Shea, director of Coutts Real Estate Investment team.

Despite a 3.9% drop in prices in the first quarter, there are definitely some strong indicators that 2024 will be a better year Prime London property than 2023. “We’ve seen increased demand from those that wanted to move in 2023 but held back due to rising inflation and rising interest rates. And Prime Central London in particular is long overdue a rebound,” says Katherine.

More listings and faster sales are positive indicators for increased market activity. “We can see from the data that some parts of the capital look extremely cheap relative to historic prices. That said, we know from the agents on our panel that there is increasing demand for ‘best-in-class turn-key’ properties. Combined with the low supply, this means buyers are often having to pay asking or above asking price to secure their desired property.” says Katherine.

Our index reveals

- Prime London prices fell 3.9% in the first quarter of the year. Prime London prices are now 1.6% lower than the same period last year and across prime London prices are 9.3% below the height of the market in 2014.

- Q1 sales volumes have been sluggish, down 7% on last year. The uncertainty in the mortgage market over the point at which we’re likely to see the first base rate cut is still putting the brakes on transaction volumes. That said, new listings are up 3.7% on last year, and up 31.5% compared to the previous quarter, which is likely to help activity.

- Property is selling faster, on average 161 days, the lowest figure we’ve seen in the last 12 quarters, suggesting there are willing buyers.

- The average discount buyers are negotiating across prime London is now 8.9%. Although slightly down on the previous quarters’ figure (9.2%), they are trending towards double-digit average discounts, showing buyers have the upper hand. In the first quarter of the year 44.9% of sales had seen their published asking price reduced and 80% of sales were sold at a discount (i.e the published asking price was reduced and/or buyers negotiated a discount from the published price).

- The super prime market is performing well. Transaction volumes across London for properties worth £10m and above are up 9.1% compared to last year.

Local Insights

- Kings Cross & Islington

Although sales volumes in Kings Cross & Islington are down significantly (down 81% on last year), prices here have reached a new peak, on average £1,278 per square foot. Only a third of property here is sold at a discount too (either where the price has been reduced from the original listing and/or where buyers have negotiated a discount from the asking price), compared to 80% on average across London.

- Mayfair & St James’s

For the last two consecutive quarters, average prices in Mayfair & St James’s have been below £2,000 per square foot, revealing significant value in this area. Before this, Q2 2017 was the last time we saw average prices in this area below £2,000 per square foot. On average, prices here are 18.6% below peak prices.

- Marylebone, Fitzrovia & Soho

Prices in Marylebone, Fitzrovia & Soho illustrate good value in other prime areas - they're 21.7% below peak levels.

- Knightsbridge & Belgravia

Likewise, Knightsbridge & Belgravia are 17.6% below peak levels.

Where are the biggest prime central discounts?

Buyers in these prime central locations are negotiating the biggest discounts. For example:

- 94% of property in South Kensington is sold at a discount to the original asking price with buyers on average negotiating 12.4% off the asking price.

- 90% of property in Chelsea is sold at a discount to the original asking price with buyers on average negotiating 10.5% off the asking price.

- 86% of property in Knightsbridge & Belgravia is sold at a discount to the original asking price with buyers on average negotiating 12.3% off the asking price.

Large discounts are less likely outside the traditional prime central areas.

In more periphery prime markets, buyers are negotiating smaller discounts. For example:

- 33% of property in Kings Cross & Islington is sold at a discount to the original asking price with buyers on average negotiating 6.4% off the asking price.

- 52% of property in Hammersmith & Chiswick is sold at a discount to the original asking price with buyers on average negotiating 4.5% off the asking price.

Considering your next move? Let Coutts help

Our real estate team could help you find the perfect property. And our bespoke mortgage service means we could provide a mortgage that’s as unique as you are.

As lending costs reduce, our range of borrowing solutions could help you and your family make your move in 2024. We also provide expert support to our international clients who might be looking to benefit from unique opportunities in prime central London.

Or contact your private banker to find out how we could help you.

Your home or property may be repossessed if you do not keep up repayments on your mortgage. Changes in the exchange rate may increase the sterling equivalent of your debt (multi-currency debt only).

Over-18s only. Terms and conditions apply. You may not be eligible for all Coutts mortgage solutions. Security may be required. Product fees may apply.

More insights